Australia’s foodservice industry is in the grip of a deepening crisis, with new data showing that cafés, restaurants, and takeaway businesses are now failing at the highest rate of any industry in the country — a stark warning for operators still fighting to stay afloat in a punishing cost environment.

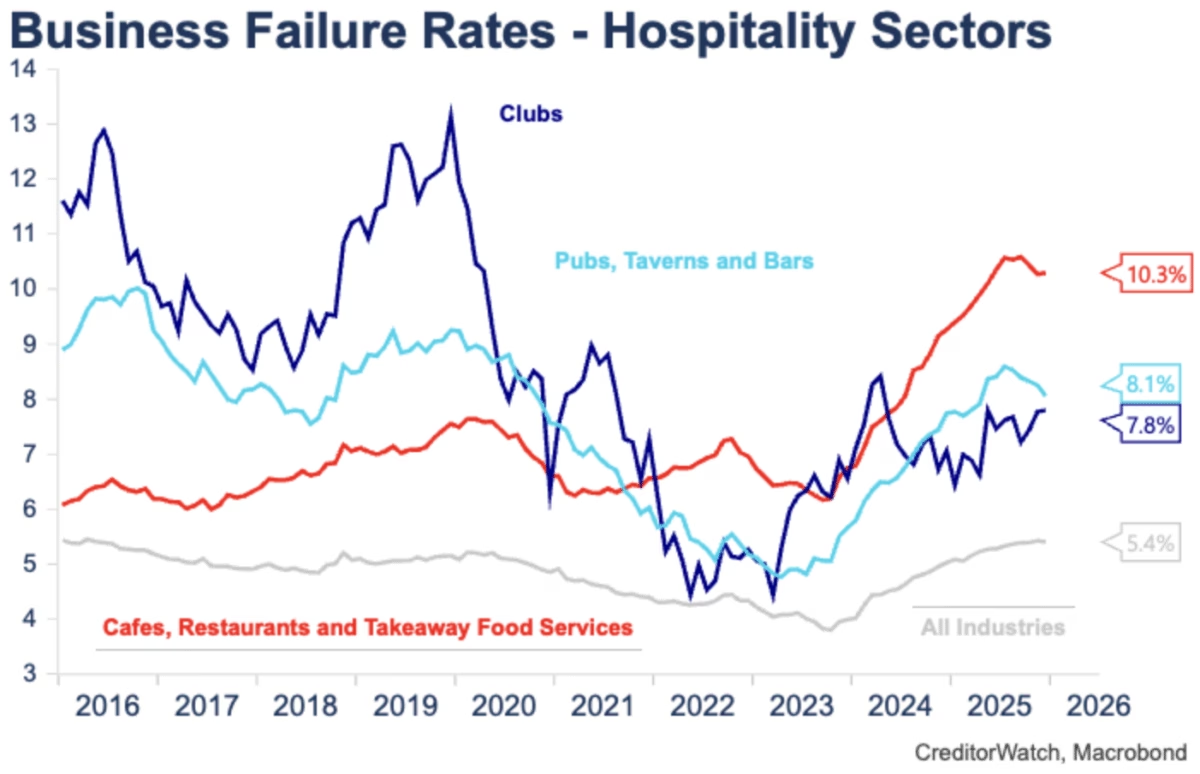

According to the January 2026 Business Risk Index from financial intelligence firm CreditorWatch, 10.4% of foodservice businesses closed over the past year. That’s almost double the economy-wide average of 5.4% and the worst failure rate across all industries tracked.

“These numbers show the hospitality sector has effectively split in two,” said CreditorWatch CEO Patrick Coghlan. “Asset-backed pubs and clubs are holding firm, but cafés and restaurants are operating on razor-thin margins with very little room for error.”

A tale of two hospitality sectors

The data reveals a stark divergence within hospitality. While pubs, taverns, and bars are also closing at above-average rates — around 8% annually — they are proving far more resilient, buoyed by stronger cash flows, higher beverage margins, and greater asset backing. Clubs are faring similarly.

The contrast is even sharper when looking at payment behaviour. The share of invoices overdue by more than 60 days has climbed to 12.4% in foodservice — more than double the national average of 5.9%. Pubs and clubs, by comparison, have maintained delinquency levels of just 3.1%.

“When overdue invoices in foodservice are running at more than double the national average, that’s not cyclical noise — it’s sustained financial stress,” Coghlan said.

The cost squeeze that won’t let up

The pressures bearing down on cafés and restaurants are well-documented but relentless. Successive minimum wage increases since 2022 have eroded already-slim margins. Pandemic-era rent relief has expired, with many operators in prime retail locations now facing steep landlord increases. Food prices rose 7.5% over the past year, driven by supply chain disruptions and extreme weather events, while energy costs have also surged.

Critically, many independent operators emerged from the COVID-19 pandemic carrying higher debt loads and with limited access to additional credit, leaving little buffer against further financial shocks.

Liquor-focused venues have fared considerably better, largely because they are less exposed to fresh food price volatility and benefit from higher per-unit margins on beverages.

Consumers are pulling back

Adding to the industry’s tough conditions is a pullback in consumer spending. With real wages under strain and interest rates elevated, Australian households have been cutting back on discretionary spending. Retail data shows café and restaurant turnover has been largely flat since early 2023, with diners going out less frequently and spending less per visit when they do.

“This is less about a sudden collapse and more about an extended squeeze,” Coghlan said. “Businesses without pricing power, diversified revenue, or cash reserves are being exposed, and the pressure has been building for months.”

Small operators in the firing line

Smaller foodservice operators face the greatest peril. Unable to easily pass on cost increases without losing price-sensitive customers, many are accumulating trade payment arrears and tax debt. Hospitality leads all sectors in Australian Taxation Office defaults, and formal insolvencies in foodservice have now exceeded pre-pandemic levels.

Across the broader economy, insolvencies trended lower for much of 2025 following income tax cuts and interest rate reductions. But momentum has reversed: 1,366 insolvencies were recorded in December 2025 alone, the third-highest monthly total on record. January 2026 defaults are tracking close to previous highs, suggesting further insolvencies are likely in the months ahead.

What comes next for the sector?

CreditorWatch Chief Economist Ivan Colhoun said the outlook for 2026 remains challenging, with global geopolitical uncertainty, still-elevated interest rates, and ongoing cost-of-living pressures continuing to weigh on conditions.

“While unemployment remains low, households are still under significant financial strain,” Colhoun said. “As a result, business conditions are likely to remain challenging, and insolvencies are expected to stay elevated or rise slightly over the year ahead.”