Payday Super (PDS) is a major reform to the way compulsory superannuation (Super Guarantee, or SG) is paid in Australia. From 1 July 2026, employers will be required to pay their employees’ superannuation at the same time as salary and wages. This move away from quarterly super payments is a significant change to how payroll works for shift-based businesses.

Here, we share some advice on how to tackle the changes.

What’s changing from 1 July 2026?

From 1 July 2026, superannuation must be paid at the same time as an employee is paid their wages or salary. Funds should reach the employee’s super account within seven business days of payday (unless the employee is new or the super fund is new for existing employees, in which case the timeframe is extended to 20 days).

How should the Super Guarantee be calculated?

SG is calculated as 12% of an employee’s Qualifying Earnings (QE), which includes ordinary time earnings (OTE) and other eligible payments.

How will the Super Guarantee Charge (SGC) work?

The SGC is assessed by the ATO and applies if the employee’s fund doesn’t receive super within seven business days of payday (unless an extended timeframe applies). It’s calculated on QE, includes daily compounding interest, and an administrative uplift. The penalty is 25% or 50% of the unpaid SGC, depending on any prior penalties.

How is Single Touch Payroll (STP) affected?

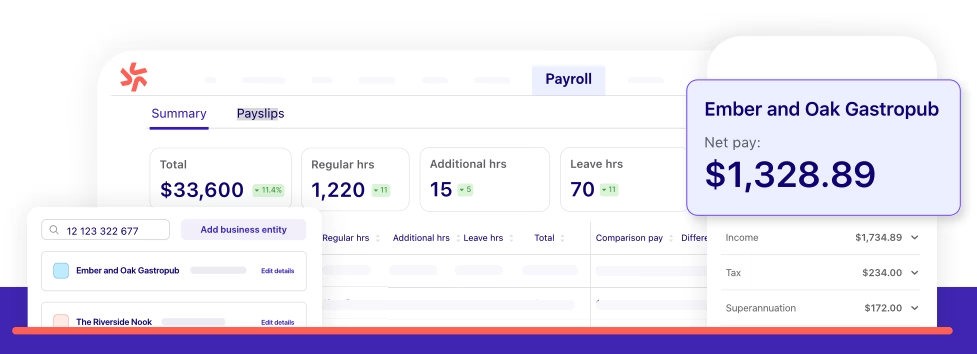

Businesses will need to report on both QE and super liability.

Will the Small Business Superannuation Clearing House (SBSCH) continue?

No, the SBSCH will close by 30 June 2026. All employers will be required to use a payroll solution that is integrated with a super clearing house.

4 payday super business considerations:

Increased transactional volume:

For example, a weekly payroll results in 52 Super payments instead of 4, making manual checks and uploads inefficient and error-prone.

Ongoing cash flow management:

Businesses must ensure funds are readily available every weekly/fortnightly/monthly payroll cycle.

Challenges of manual systems:

If payroll and super are currently managed by spreadsheets or separate systems, you may find the new seven-day deadline and increased volume unmanageable, highlighting the need for a single, integrated platform.

Stricter regulatory oversight:

The ATO will be assessing the SGC, placing the compliance burden (and risk) on the employer, making accurate, automated record-keeping critical.

Get ready for payday super

Review payroll systems

Confirm your payroll software supports Payday Super calculations, STP reporting, and on-time super payments.

Plan cash flow differently

Weekly or fortnightly payment cycles mean funds must be available each time you run payroll (not quarterly).

Update processes & training

Educate payroll and finance teams on new timing, reporting, operational requirements, and handling exceptions (e.g., new employees).

Transition from SBSCH

Move to a commercial super clearinghouse or a payroll solution like Deputy that integrates with clearinghouses for seamless processing.

Learn more and download this checklist from Payday Super (Without the Chaos): Your Practical Guide.