When Menulog announced its withdrawal from the Australian market, industry observers predicted chaos. The reality, according to new data from Brizo FoodMetrics, tells a different story—one that reveals just how consolidated and interconnected Australia’s delivery ecosystem has become.

A market dominated by choice

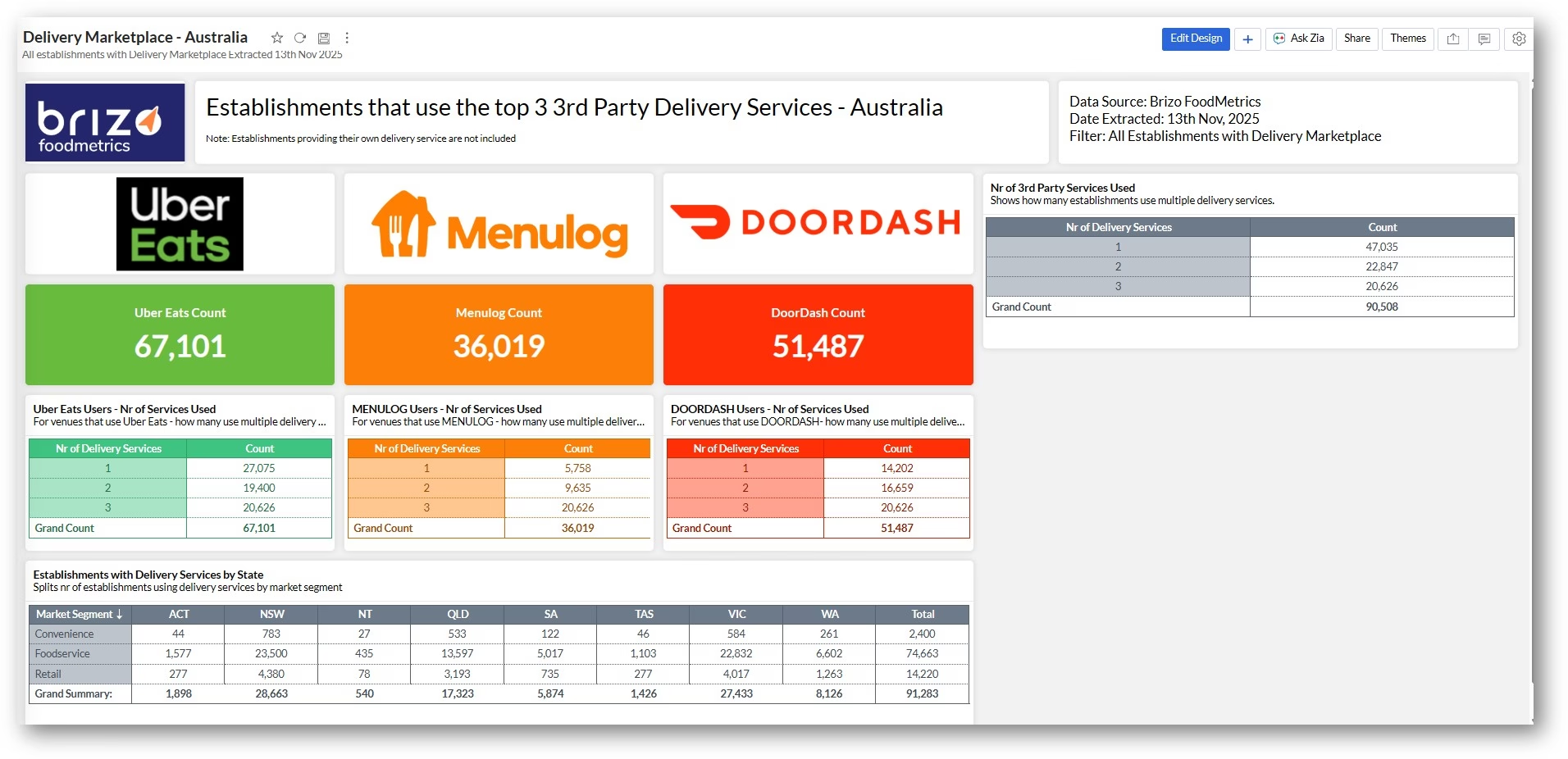

Of the 90,508 Australian establishments offering third-party delivery services, only 16% used Menulog exclusively. That’s just 5,758 venues out of Menulog’s 36,019 total partners—meaning 84% of restaurants already had alternative delivery channels in place.

Even more telling: 57% of Menulog users operated on all three major platforms simultaneously, compared to just 31% of Uber Eats customers who felt compelled to cast such a wide net.

This suggests Menulog’s service proposition wasn’t compelling enough to stand alone, forcing operators into a multi-platform strategy simply to remain competitive.

The scale gap is clear

The numbers expose another uncomfortable truth: Menulog was already losing the battle for market presence.

With 67,101 venue partnerships, Uber Eats commanded nearly double Menulog’s footprint. DoorDash, at 51,487, wasn’t far behind. For most operators, Menulog represented their third choice, not their primary channel.

The foodservice sector breakdown reveals where the real impact lies.

While Menulog served 13,597 quick-service restaurants in Queensland and 23,500 foodservice operators in New South Wales, these establishments weren’t dependent on the platform.

The high overlap rates suggest they’ll simply redirect customers to their existing Uber Eats or DoorDash integrations—platforms they already manage.

What this means for operators

The Menulog exit serves as a cautionary tale about the economics of multi-platform delivery.

Restaurants that spread themselves across three services were paying triple the commission fees, managing three separate tablets, and training staff on three different systems.

For many, losing one platform means operational simplification, not catastrophe.

The 5,758 Menulog-exclusive venues face a genuine transition, but even they operate in a market where competitors are eager to onboard new partners.

The delivery infrastructure doesn’t disappear—it just consolidates under different branding.

Rod Fowler is the Director of Food Industry Foresight. In this article, he uses data from Brizo FoodMetrics.